In crypto futures trading, chart patterns are visual maps of market psychology. They help traders predict whether a trend will continue, reverse, or break out from a period of indecision. By identifying these formations on candlestick charts, you can set precise entry points, stop-losses, and profit targets.

I. The Three Main Categories

| Category | Market Sentiment | Trading Goal |

| Continuation | Market is taking a “breather” before resuming its path. | Join the existing trend during a pause. |

| Reversal | Momentum is fading; a 180-degree turn is likely. | Exit current positions or trade the new direction. |

| Bilateral | High uncertainty; price is “coiling” for a big move. | Wait for a breakout in either direction to enter. |

II. Top 10 Patterns At a Glance

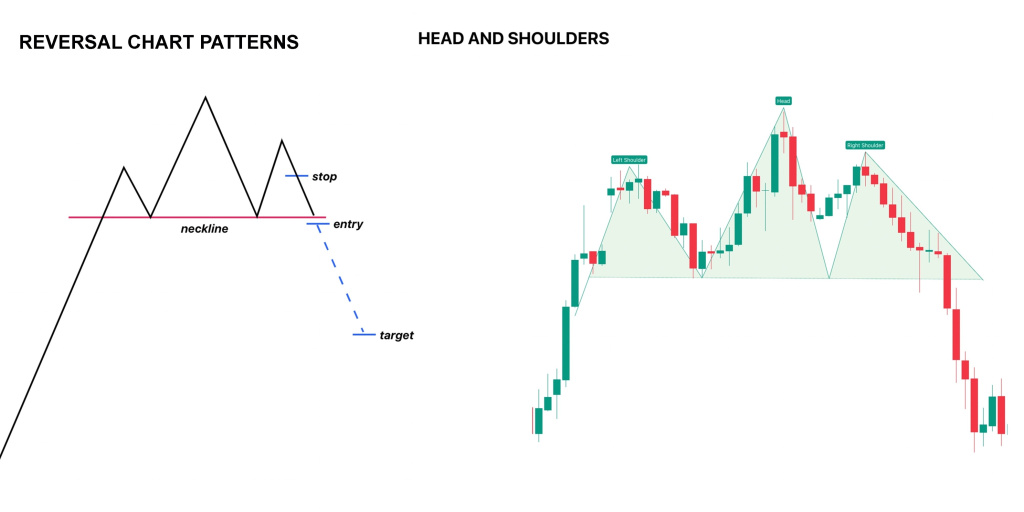

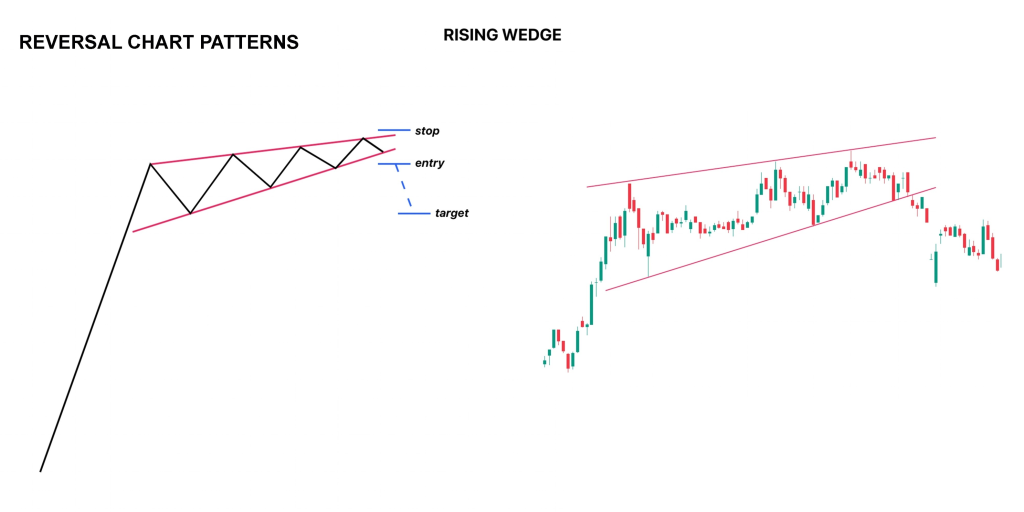

1. Reversal Patterns (Trend Shifters)

Head and Shoulders: Three peaks, with the middle (head) being the highest. Breaking the “neckline” support signals a move from bullish to bearish.

Double Top / Bottom: The price hits a ceiling or floor twice but fails to break it, forming an “M” (bearish) or “W” (bullish) shape.

Rising / Falling Wedges: Converging trendlines where the price is squeezed. A Rising Wedge often breaks downward, while a Falling Wedge often breaks upward.

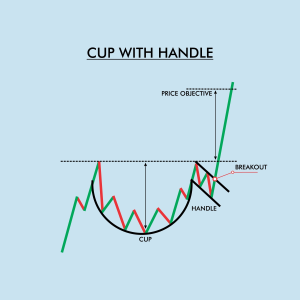

2. Continuation Patterns (Trend Builders)

Bull / Bear Flags: A sharp vertical price move (the flagpole) followed by a brief, rectangular consolidation (the flag). It usually explodes in the direction of the pole.

Cup and Handle: A U-shaped “cup” followed by a slight downward drift (the handle). A breakout above the handle confirms the bullish trend.

Ascending / Descending Triangles:

Ascending: Flat top and rising bottom (Bullish).

Descending: Flat bottom and falling top (Bearish).

3. Bilateral Patterns (The Coiling Spring)

Symmetrical Triangle: The price makes lower highs and higher lows simultaneously. Because the market is undecided, you trade whichever side breaks first with high volume.

III. Practical Application in Futures

Wait for the Close: In crypto, “wicks” (the thin lines on candles) often poke out of a pattern and retract. Only enter a trade once a candle closes outside the pattern boundary.

Confirm with Volume: A real breakout should be accompanied by a spike in trading volume. If volume is low, it might be a “fakeout.”

The “Retest” Entry: Often, the price breaks out, comes back to touch the pattern’s edge, and then takes off. This retest is frequently the safest entry point for a futures contract.

Leave a Reply